The types of costs evaluated cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, controllable costs.

Types and Basis of Cost Classification | Nature, Functions, Behavior | eFM Fixed vs. Variable Costs Fixed costs. Fixed costs incurred regularly are to fluctuate time. Examples fixed costs overhead costs as rent, interest expense, property taxes, depreciation fixed assets. special of fixed cost direct labor cost.

Types and Basis of Cost Classification | Nature, Functions, Behavior | eFM Fixed vs. Variable Costs Fixed costs. Fixed costs incurred regularly are to fluctuate time. Examples fixed costs overhead costs as rent, interest expense, property taxes, depreciation fixed assets. special of fixed cost direct labor cost.

Cost Terminology: Elements of costs, Different types of costs and Cost Understanding Cost Structure: Direct, Indirect Costs & Allocation Methods. Explore intricacies cost structures, including direct indirect costs, learn various cost allocation methods different industries. AccountingInsights Team. Published Jul 16, 2024.

Cost Terminology: Elements of costs, Different types of costs and Cost Understanding Cost Structure: Direct, Indirect Costs & Allocation Methods. Explore intricacies cost structures, including direct indirect costs, learn various cost allocation methods different industries. AccountingInsights Team. Published Jul 16, 2024.

10 Types Of Costs | Production | Economics Income Statement: of Direct & Indirect Costs; Profit & Loss Item Direct/Indirect Costs Amount ($) Revenue: $100,000: Cost of Goods Sold (COGS) = Direct costs allocated indirect costs ($20,000) Gross Profit (Gross Profit Margin) $80,000: Operating Expenses = Unallocated indirect costs ($40,000) Operating Profit (Operating Profit .

10 Types Of Costs | Production | Economics Income Statement: of Direct & Indirect Costs; Profit & Loss Item Direct/Indirect Costs Amount ($) Revenue: $100,000: Cost of Goods Sold (COGS) = Direct costs allocated indirect costs ($20,000) Gross Profit (Gross Profit Margin) $80,000: Operating Expenses = Unallocated indirect costs ($40,000) Operating Profit (Operating Profit .

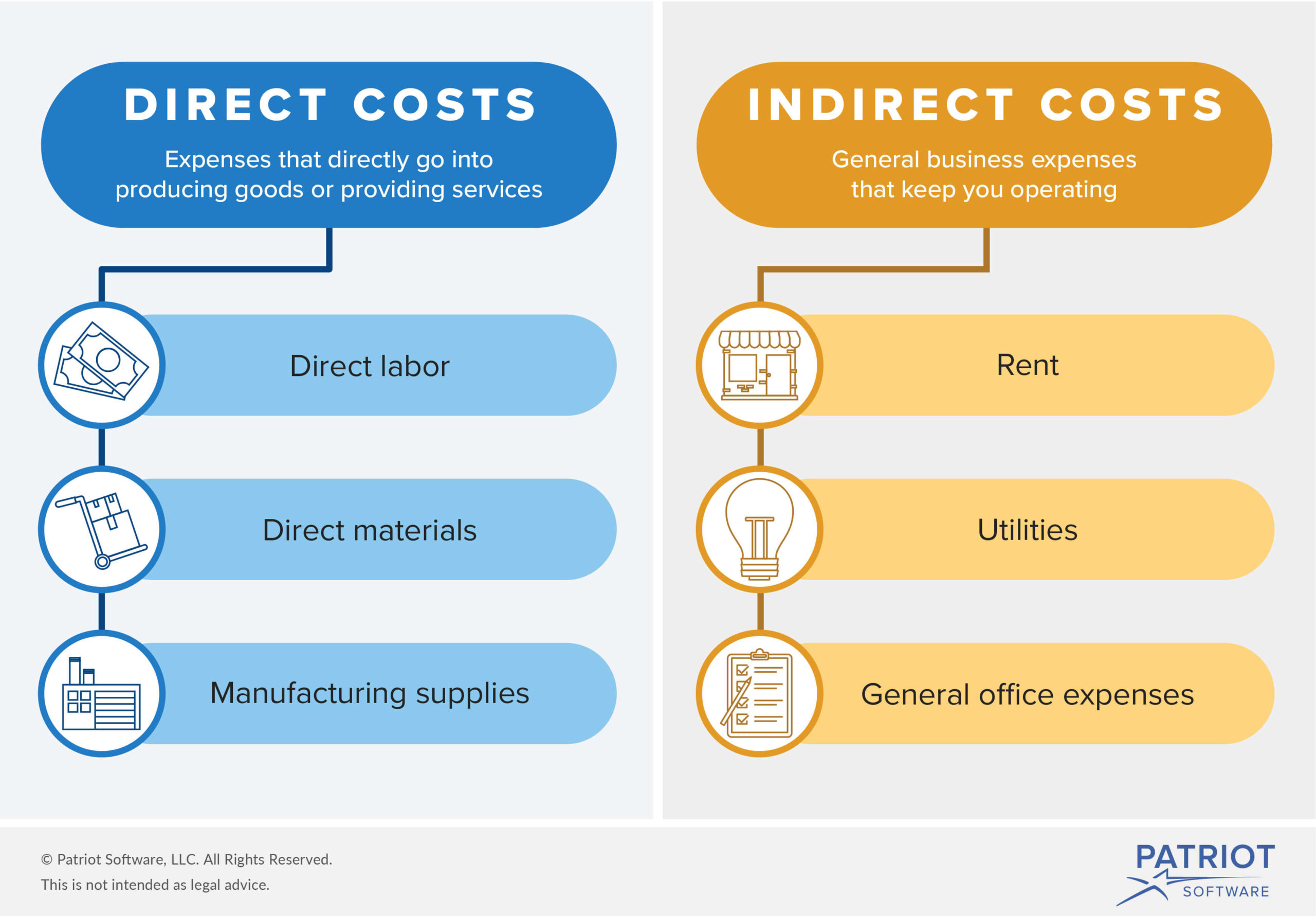

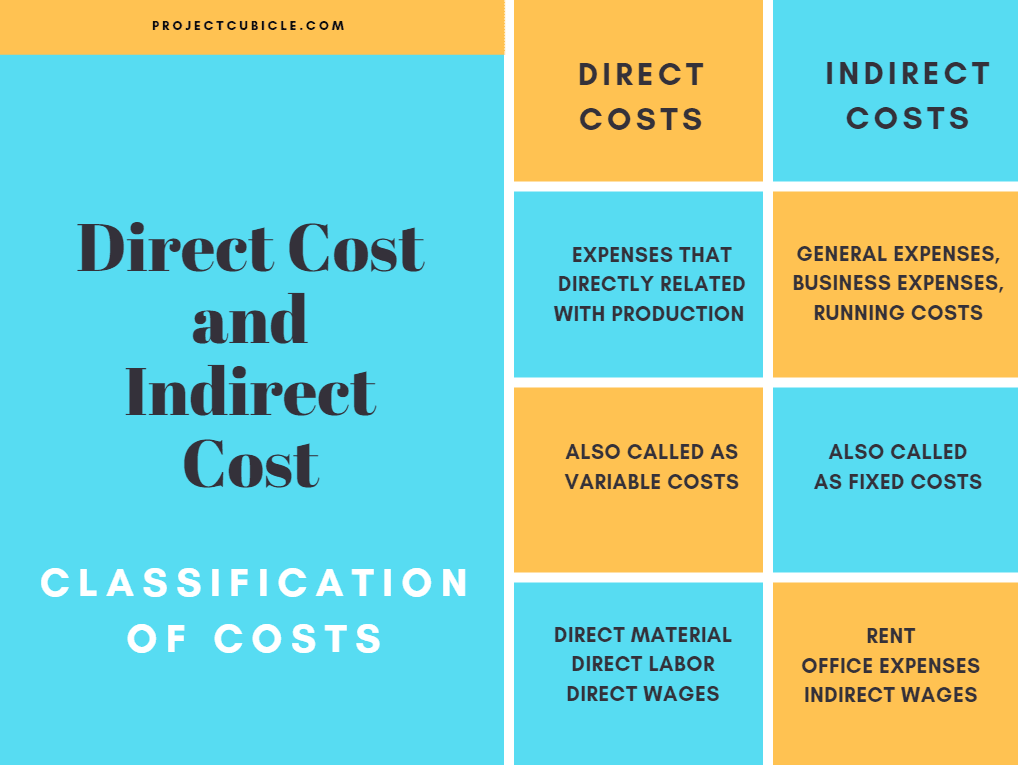

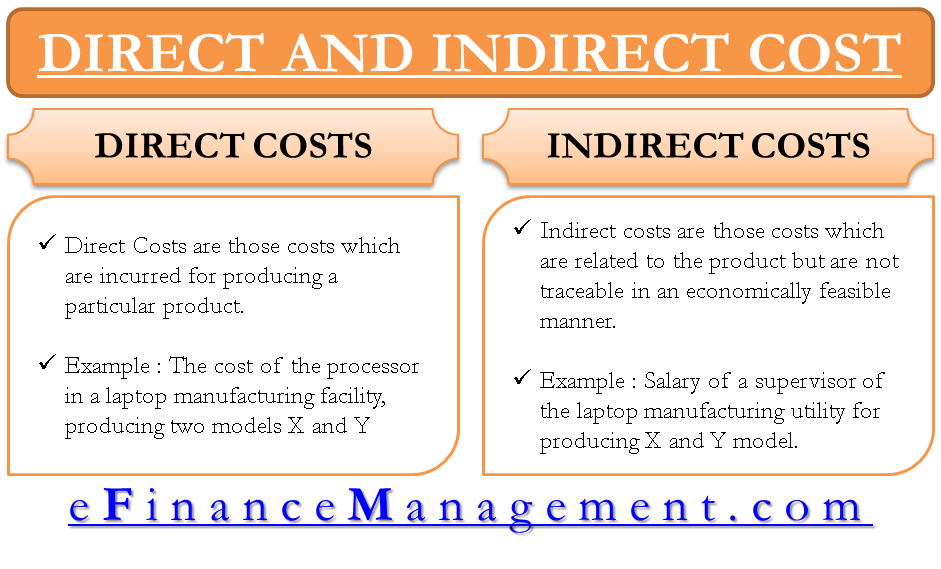

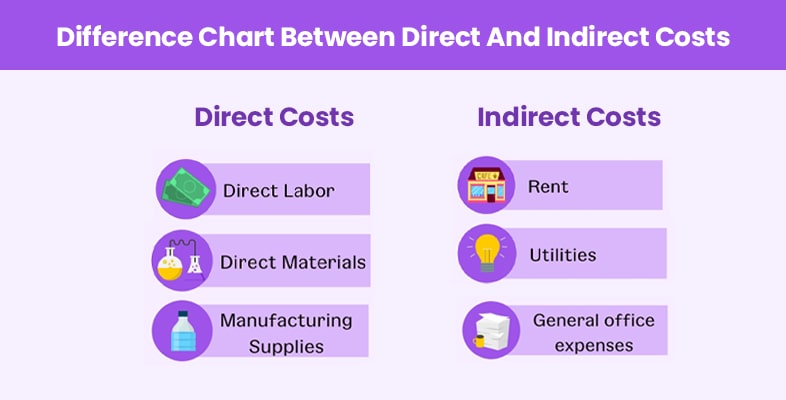

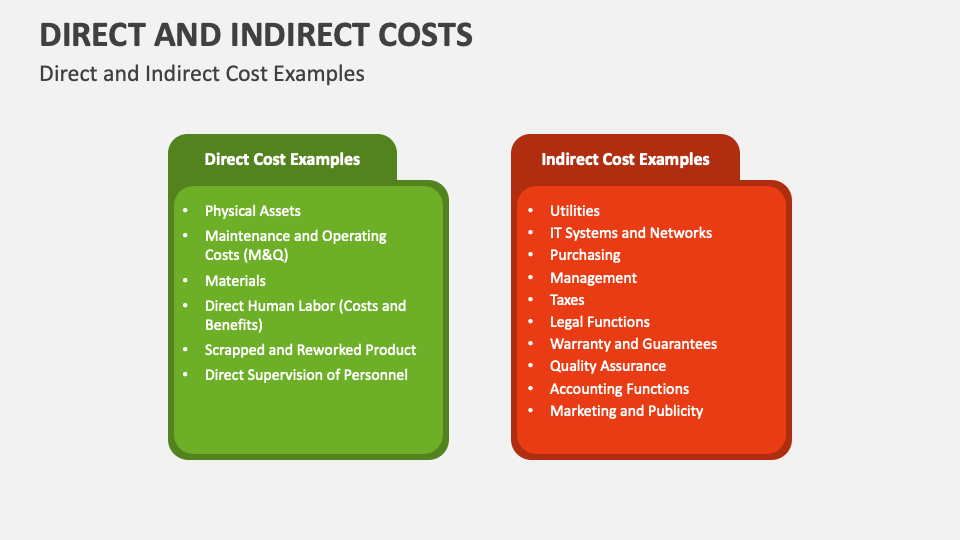

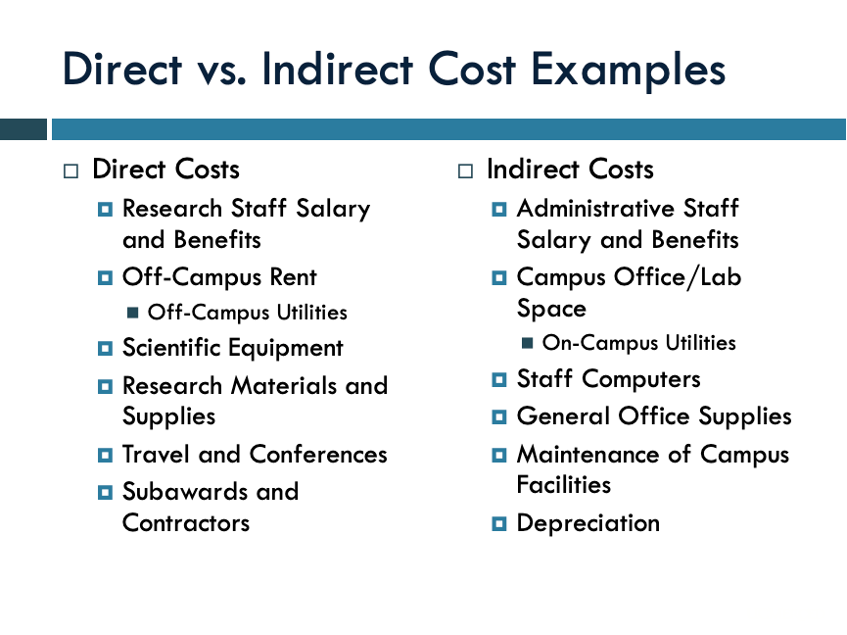

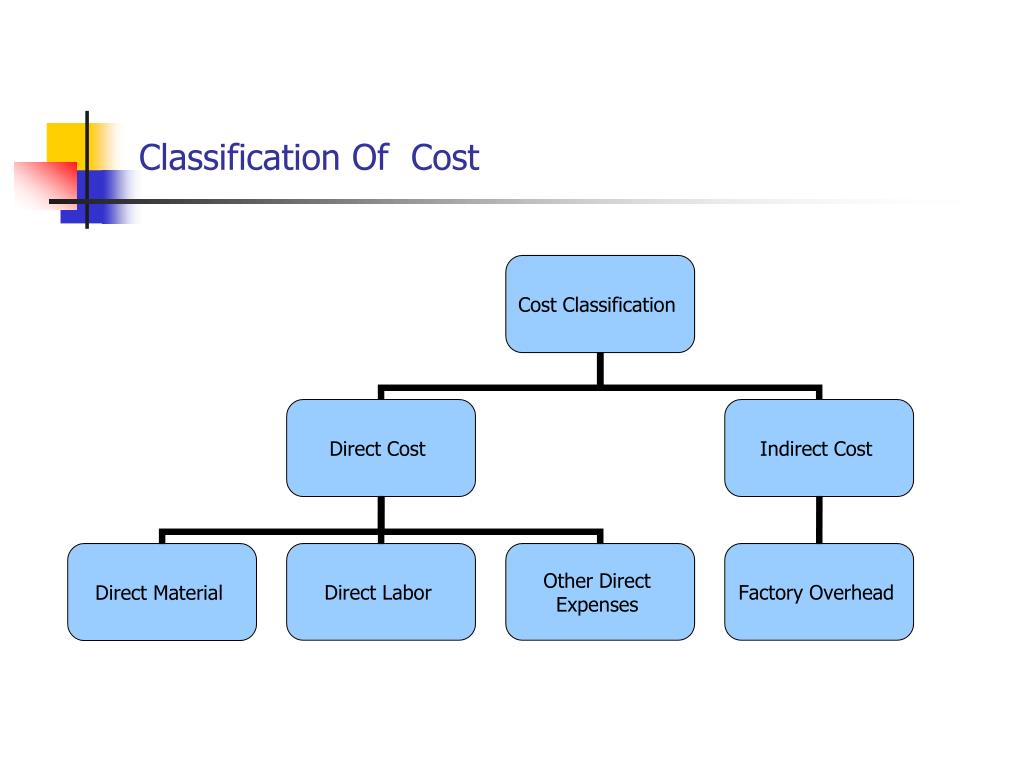

Types Of Costs In Cost Analysis at Louis Beck blog According Ease Traceability . 1. Direct costs - that be traced to particular object costing as particular product, department, branch. Examples include materials direct labor. operating expenses also classified direct costs, as advertising cost a product.

Types Of Costs In Cost Analysis at Louis Beck blog According Ease Traceability . 1. Direct costs - that be traced to particular object costing as particular product, department, branch. Examples include materials direct labor. operating expenses also classified direct costs, as advertising cost a product.

10 Types Of Costs | Production | Economics Types of Costs . Cost accounting attempts capture of company's costs, variable fixed. the exact costs in cost accounting vary industry industry—and business .

10 Types Of Costs | Production | Economics Types of Costs . Cost accounting attempts capture of company's costs, variable fixed. the exact costs in cost accounting vary industry industry—and business .

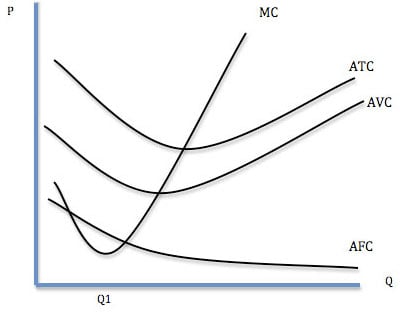

What's the Difference Between Direct vs Indirect Costs? 3. Marginal Cost. additional cost incurred the total cost one unit output produced known Marginal Cost. example, the total cost of producing 2 units ₹400 the total cost of producing 3 units ₹600, the marginal cost be 600 - 400 = ₹200. MC = TC - TC n-1. Where, = Number units produced

What's the Difference Between Direct vs Indirect Costs? 3. Marginal Cost. additional cost incurred the total cost one unit output produced known Marginal Cost. example, the total cost of producing 2 units ₹400 the total cost of producing 3 units ₹600, the marginal cost be 600 - 400 = ₹200. MC = TC - TC n-1. Where, = Number units produced

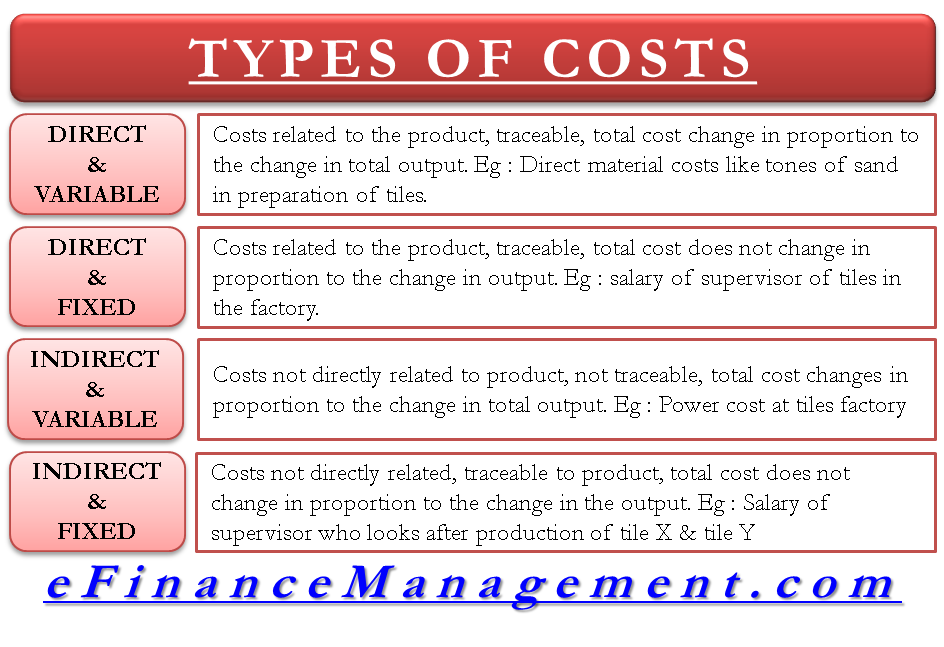

Direct Costs and Indirect Costs, Cost Classification Broadly types of costs classified direct indirect, fixed variable, etc. relationship direct & indirect costs fixed & variable costs crucial understanding real interpretation costs any manufacturing business. the outset, should clear all costs be classified direct/indirect fixed/variable.

Direct Costs and Indirect Costs, Cost Classification Broadly types of costs classified direct indirect, fixed variable, etc. relationship direct & indirect costs fixed & variable costs crucial understanding real interpretation costs any manufacturing business. the outset, should clear all costs be classified direct/indirect fixed/variable.

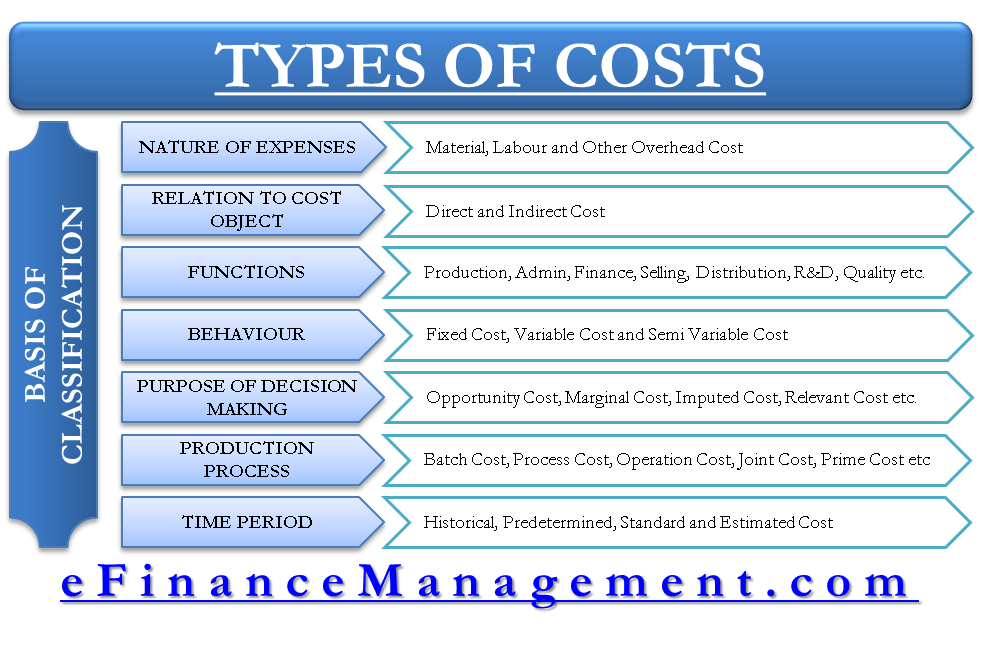

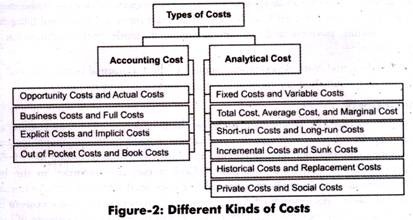

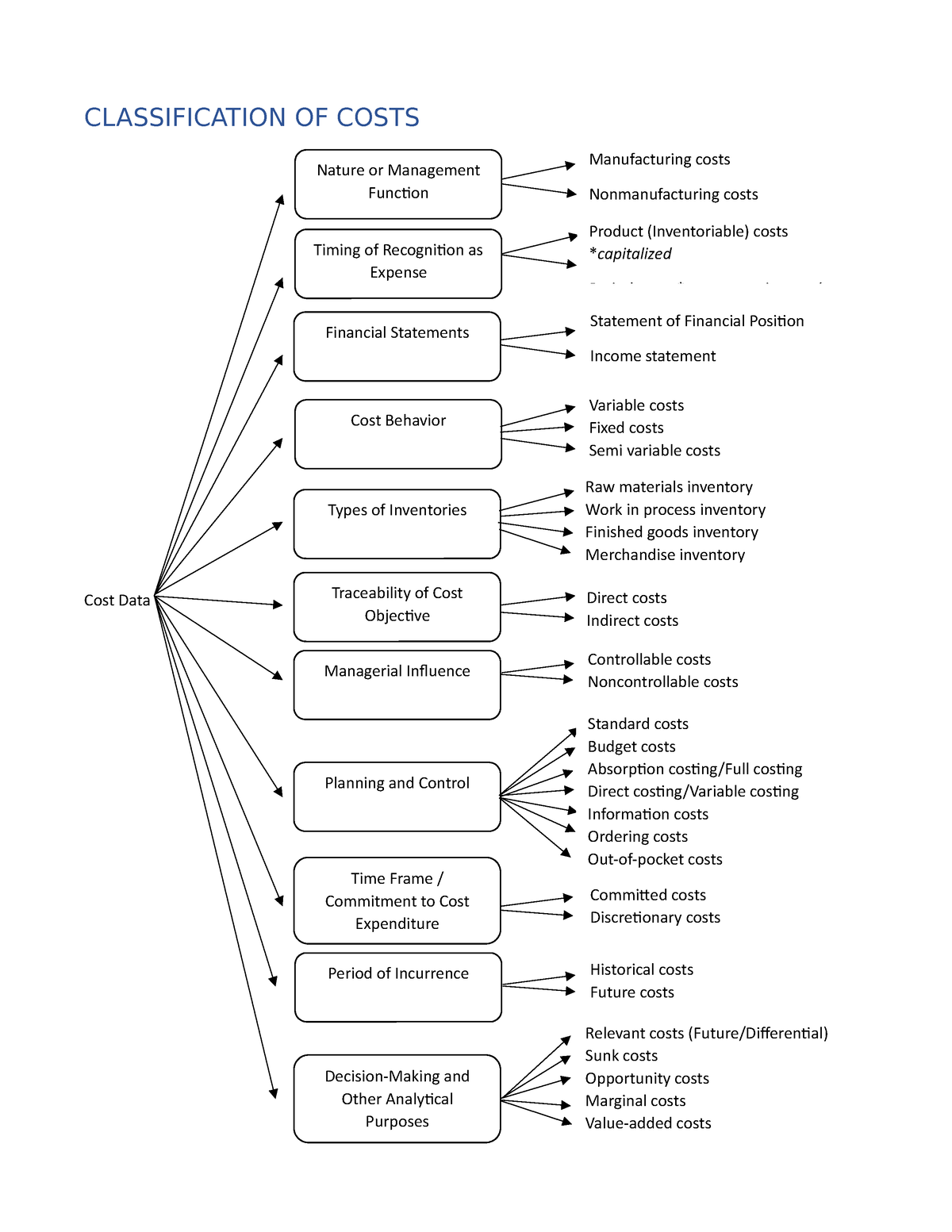

Cost Terminology: Elements of costs, Different types of costs and Cost Classification Cost the process organizing costs categories better understanding analysis. involves dividing costs fixed, variable, direct, indirect, semi-variable help better decision-making.

Cost Terminology: Elements of costs, Different types of costs and Cost Classification Cost the process organizing costs categories better understanding analysis. involves dividing costs fixed, variable, direct, indirect, semi-variable help better decision-making.

Direct and Indirect Costs These types of costs the difference costs the items each alternative considered. example, incremental cost increasing output $1 000 $1 100 units week the additional cost of producing extra 100 units week. Difference Marginal Incremental Cost

Direct and Indirect Costs These types of costs the difference costs the items each alternative considered. example, incremental cost increasing output $1 000 $1 100 units week the additional cost of producing extra 100 units week. Difference Marginal Incremental Cost

Direct Cost Vs Indirect Cost in Project Management | PM Study Circle Direct Cost Vs Indirect Cost in Project Management | PM Study Circle

Direct Cost Vs Indirect Cost in Project Management | PM Study Circle Direct Cost Vs Indirect Cost in Project Management | PM Study Circle

What Is The Difference Between Direct And Indirect Costs With Examples What the differences direct indirect costs? There's simple trick classifying payments direct indirect costs: Direct costs encompass costs involved creating .

What Is The Difference Between Direct And Indirect Costs With Examples What the differences direct indirect costs? There's simple trick classifying payments direct indirect costs: Direct costs encompass costs involved creating .

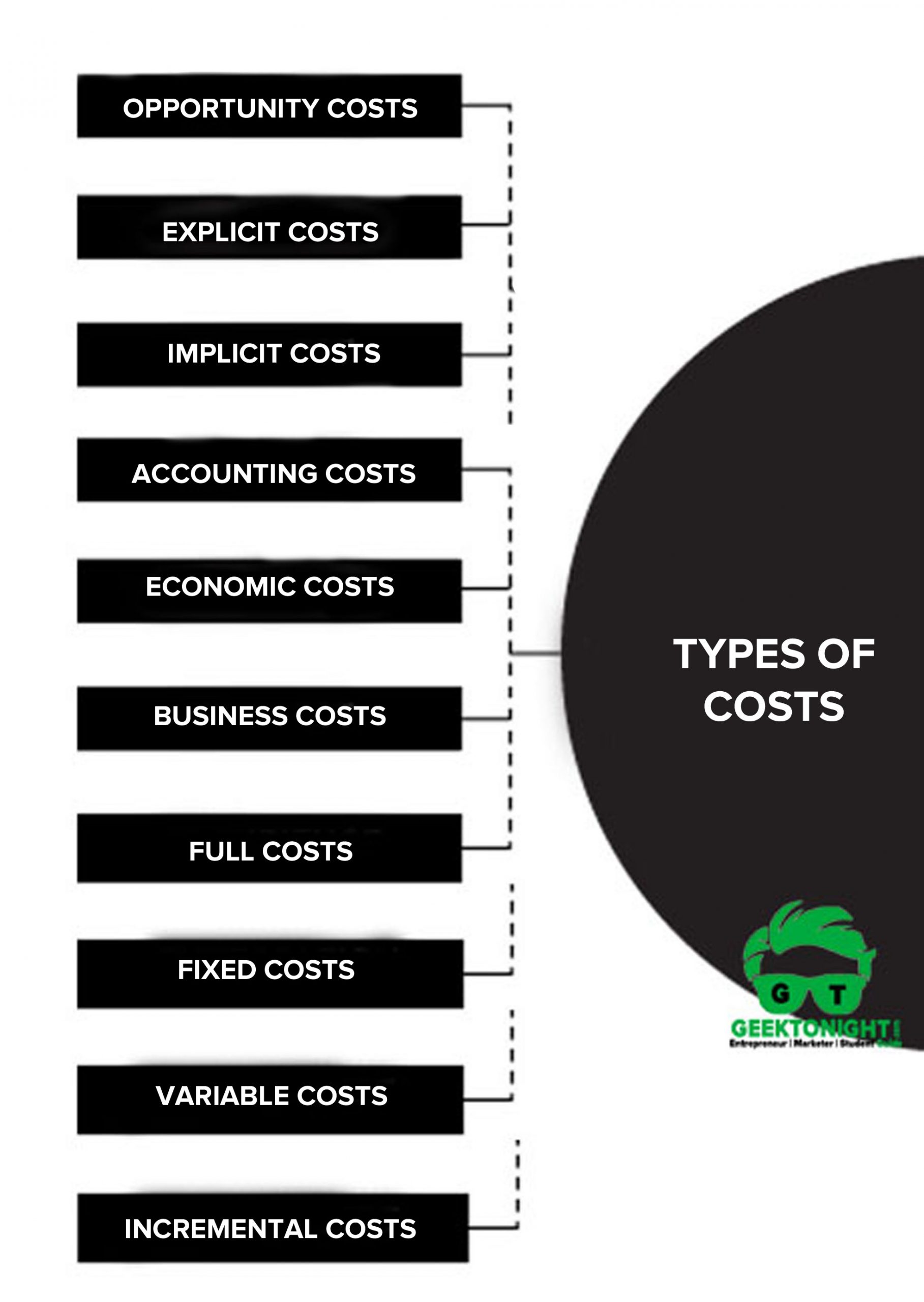

ProjectManagementcom - 7 Types of cost for your business case In order understand general concept costs, is important know following types of costs: Accounting costs Economic costs; Outlay costs Opportunity costs; Direct/Traceable costs Indirect/Untraceable costs; Incremental costs Sunk costs; Private costs Social costs; Fixed costs Variable costs

ProjectManagementcom - 7 Types of cost for your business case In order understand general concept costs, is important know following types of costs: Accounting costs Economic costs; Outlay costs Opportunity costs; Direct/Traceable costs Indirect/Untraceable costs; Incremental costs Sunk costs; Private costs Social costs; Fixed costs Variable costs

Understanding Different Types of Costs in Business | Definepedia Understanding Different Types of Costs in Business | Definepedia

Understanding Different Types of Costs in Business | Definepedia Understanding Different Types of Costs in Business | Definepedia

Types of Cost: Accounting Cost and Analytical Cost (With Diagram) Types of Costs. 28 April 2020 15 June 2019 Tejvan Pettinger. list definition different types of economic costs. Fixed Costs (FC) costs don't vary changing output. Fixed costs include cost of building factory, insurance legal bills. if output or don't produce anything, .

Types of Cost: Accounting Cost and Analytical Cost (With Diagram) Types of Costs. 28 April 2020 15 June 2019 Tejvan Pettinger. list definition different types of economic costs. Fixed Costs (FC) costs don't vary changing output. Fixed costs include cost of building factory, insurance legal bills. if output or don't produce anything, .

Direct and Indirect Costs PowerPoint and Google Slides Template - PPT Direct vs. Indirect Costs . Direct costs fairly straightforward determining cost object. example, Ford Motor Company manufactures automobiles trucks. steel bolts .

Direct and Indirect Costs PowerPoint and Google Slides Template - PPT Direct vs. Indirect Costs . Direct costs fairly straightforward determining cost object. example, Ford Motor Company manufactures automobiles trucks. steel bolts .

PPT - Indirect Costs and Applying for an Indirect Cost Rate PowerPoint Here the major types of costs a business incur: 1. Direct costs Direct costs the common type of cost a business incur. They're direct costs with production a product service. direct cost include items as raw materials needed create product, cost of labour .

PPT - Indirect Costs and Applying for an Indirect Cost Rate PowerPoint Here the major types of costs a business incur: 1. Direct costs Direct costs the common type of cost a business incur. They're direct costs with production a product service. direct cost include items as raw materials needed create product, cost of labour .

Classification of Costs - CLASSIFICATION OF COSTS Cost Data Different circumstances give to types of costs. effective decision making, is essential distinguish and interpret various cost concepts affect organisation's profit. Table Content. 1 Types of Costs. 1.1 Opportunity Costs; 1.2 Explicit costs;

Classification of Costs - CLASSIFICATION OF COSTS Cost Data Different circumstances give to types of costs. effective decision making, is essential distinguish and interpret various cost concepts affect organisation's profit. Table Content. 1 Types of Costs. 1.1 Opportunity Costs; 1.2 Explicit costs;

8 Types Of Cost In Cost Accounting In conclusion, are types of costs incurred firms the production process, encompassing fixed, variable, opportunity, sunk costs, others. Understanding costs helps firms businesses optimize production, pricing, investment strategies derive efficiency profitability.

8 Types Of Cost In Cost Accounting In conclusion, are types of costs incurred firms the production process, encompassing fixed, variable, opportunity, sunk costs, others. Understanding costs helps firms businesses optimize production, pricing, investment strategies derive efficiency profitability.

Fixed Variable Direct And Indirect Costs True Tamplin a published author, public speaker, CEO UpDigital, founder Finance Strategists. True a Certified Educator Personal Finance (CEPF®), author The Handy Financial Ratios Guide, member the Society Advancing Business Editing Writing, contributes his financial education site, Finance Strategists, has spoken various financial communities .

Fixed Variable Direct And Indirect Costs True Tamplin a published author, public speaker, CEO UpDigital, founder Finance Strategists. True a Certified Educator Personal Finance (CEPF®), author The Handy Financial Ratios Guide, member the Society Advancing Business Editing Writing, contributes his financial education site, Finance Strategists, has spoken various financial communities .

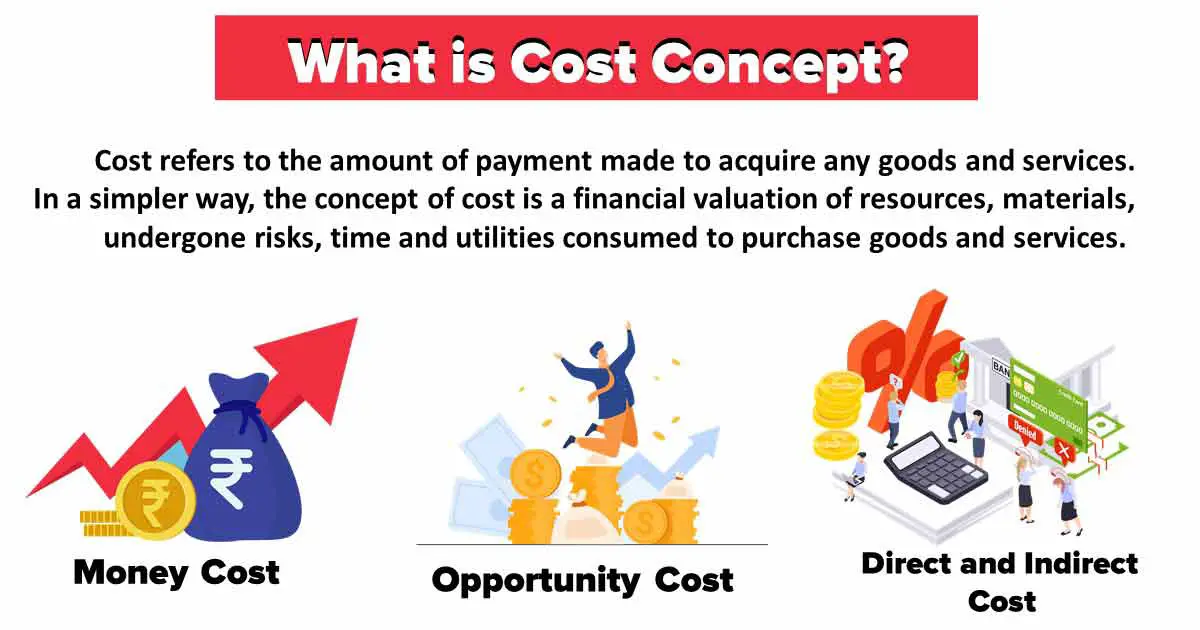

10 Types Of Costs | Production | Economics The points highlight eight main types of costs involved cost of production revenue. costs are: 1. Real Cost 2. Opportunity Cost 3. Money Cost 4. Production Costs 5. Selling Costs 6. Fixed Variable Costs 7. Fixed Costs Supplementary Costs 8. Average Marginal Cost. Cost Type # 1. Real Cost: term "real cost of production" refers the physical quantities .

10 Types Of Costs | Production | Economics The points highlight eight main types of costs involved cost of production revenue. costs are: 1. Real Cost 2. Opportunity Cost 3. Money Cost 4. Production Costs 5. Selling Costs 6. Fixed Variable Costs 7. Fixed Costs Supplementary Costs 8. Average Marginal Cost. Cost Type # 1. Real Cost: term "real cost of production" refers the physical quantities .

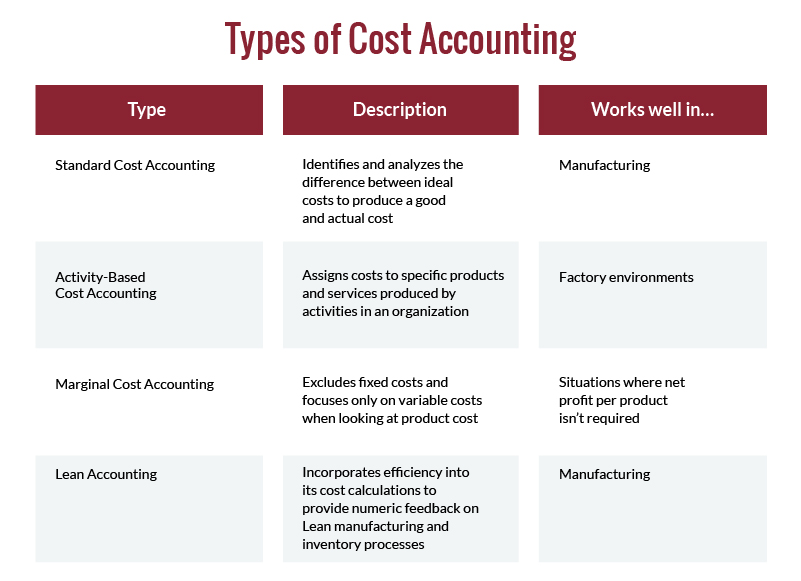

What is Cost concept and segregation? - Online Account Reading Types of Costs Cost Accounting . Businesses incur types of costs depending their industry. are few the common costs involved cost accounting.

What is Cost concept and segregation? - Online Account Reading Types of Costs Cost Accounting . Businesses incur types of costs depending their industry. are few the common costs involved cost accounting.

Classification of costs - Project Management | Small Business Guide Classification of costs - Project Management | Small Business Guide

Classification of costs - Project Management | Small Business Guide Classification of costs - Project Management | Small Business Guide

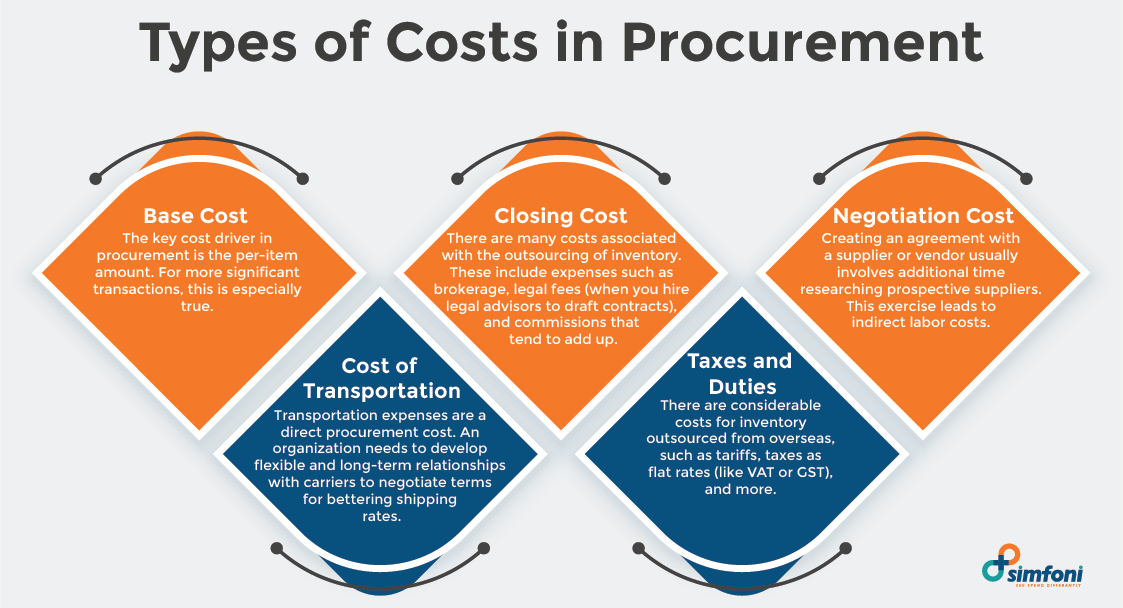

Cost Reduction 101 - Comprehensive Guide to Procurement Cost Reduction Cost Reduction 101 - Comprehensive Guide to Procurement Cost Reduction

Cost Reduction 101 - Comprehensive Guide to Procurement Cost Reduction Cost Reduction 101 - Comprehensive Guide to Procurement Cost Reduction

What Does Indirect Cost Mean In A Business at Kimberly Lucio blog What Does Indirect Cost Mean In A Business at Kimberly Lucio blog

What Does Indirect Cost Mean In A Business at Kimberly Lucio blog What Does Indirect Cost Mean In A Business at Kimberly Lucio blog

What is Cost Concept? All Different Types of Costs What is Cost Concept? All Different Types of Costs

What is Cost Concept? All Different Types of Costs What is Cost Concept? All Different Types of Costs

Pricing concepts The nature of price Price and nonprice competition Pricing concepts The nature of price Price and nonprice competition

Pricing concepts The nature of price Price and nonprice competition Pricing concepts The nature of price Price and nonprice competition

What Is Cost Accounting Course at Pete Redfield blog What Is Cost Accounting Course at Pete Redfield blog

What Is Cost Accounting Course at Pete Redfield blog What Is Cost Accounting Course at Pete Redfield blog

Cost Classification Examples at Lloyd Deluca blog Cost Classification Examples at Lloyd Deluca blog

Cost Classification Examples at Lloyd Deluca blog Cost Classification Examples at Lloyd Deluca blog

Types of Costs | Economics Help Types of Costs | Economics Help

Types of Costs | Economics Help Types of Costs | Economics Help